Strategies for Cost-Effective Offshore Firm Formation

When thinking about overseas company formation, the pursuit for cost-effectiveness becomes a critical problem for businesses looking for to increase their procedures internationally. In a landscape where financial carefulness preponderates, the techniques utilized in structuring overseas entities can make all the distinction in achieving monetary efficiency and operational success. From navigating the complexities of territory choice to implementing tax-efficient structures, the journey towards developing an overseas visibility is raging with challenges and opportunities. By checking out nuanced techniques that mix lawful conformity, financial optimization, and technological advancements, companies can begin on a course towards offshore business formation that is both economically prudent and strategically sound.

Picking the Right Territory

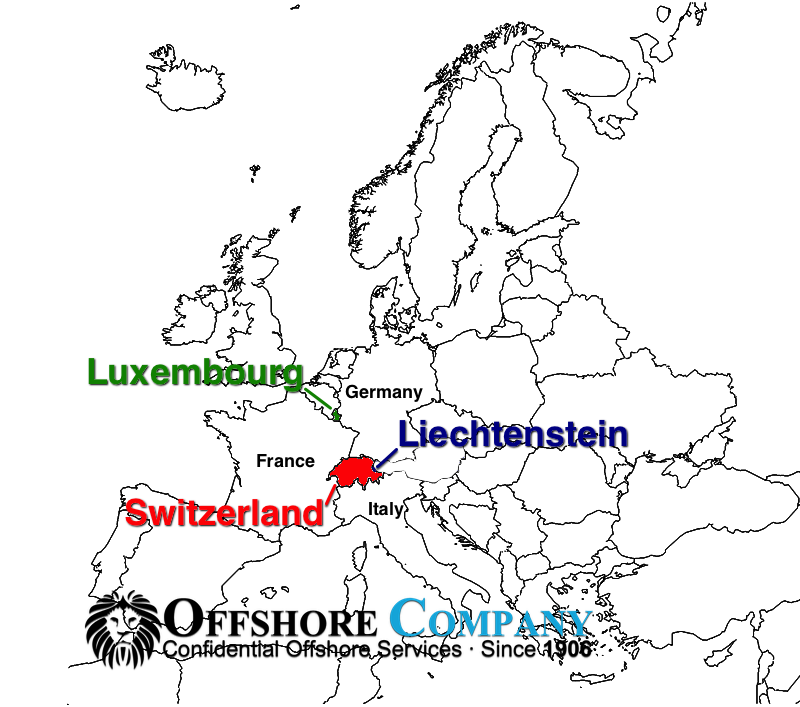

When developing an offshore company, picking the ideal jurisdiction is a critical choice that can dramatically affect the success and cost-effectiveness of the development process. The jurisdiction picked will certainly identify the regulatory structure within which the business operates, influencing tax, reporting requirements, privacy legislations, and overall organization versatility.

When choosing a territory for your offshore business, several variables should be considered to make certain the decision straightens with your tactical objectives. One vital aspect is the tax obligation program of the territory, as it can have a substantial influence on the firm's success. In addition, the level of regulative conformity needed, the economic and political stability of the territory, and the ease of operating must all be assessed.

In addition, the credibility of the territory in the global business neighborhood is crucial, as it can influence the understanding of your firm by customers, companions, and banks - offshore company formation. By meticulously evaluating these aspects and looking for professional recommendations, you can pick the right jurisdiction for your offshore business that enhances cost-effectiveness and sustains your organization purposes

Structuring Your Business Efficiently

To ensure ideal efficiency in structuring your offshore firm, precise focus should be offered to the organizational structure. The initial step is to specify the company's possession framework clearly. This consists of determining the shareholders, police officers, and supervisors, in addition to their obligations and duties. By developing a transparent ownership structure, you can make certain smooth decision-making procedures and clear lines of authority within the company.

Following, it is important to take into consideration the tax implications of the picked framework. Various territories provide differing tax advantages and rewards for offshore firms. By carefully assessing the tax obligation laws and laws of the selected jurisdiction, you can maximize your company's tax obligation effectiveness and minimize unnecessary expenditures.

Moreover, keeping appropriate documentation and records is vital for the efficient structuring of your offshore firm. By keeping precise and updated records of economic purchases, business decisions, and conformity records, you can make certain openness and responsibility within the organization. This not only facilitates smooth procedures however likewise helps in check my reference showing compliance with regulatory needs.

Leveraging Innovation for Cost Savings

Efficient structuring of your offshore company not just pivots on thorough focus to business frameworks but also on leveraging innovation for cost savings. One method to take advantage of modern technology for financial savings in overseas firm development is by making use of cloud-based solutions for information storage space and cooperation. By incorporating modern technology purposefully right into your overseas firm development process, you can accomplish considerable cost savings while enhancing operational effectiveness.

Minimizing Tax Responsibilities

Utilizing critical tax preparation methods can effectively lower the financial burden of tax obligation liabilities for overseas companies. In addition, taking advantage of tax obligation rewards and exceptions provided by the territory where the offshore firm is registered can result in considerable savings.

One more approach to lessening tax obligations is by structuring the overseas business in a tax-efficient fashion - offshore company formation. This involves meticulously developing the ownership and operational structure to maximize tax obligation advantages. Establishing up a holding company in a jurisdiction with desirable tax Click This Link legislations can assist decrease and consolidate revenues tax obligation direct exposure.

Additionally, remaining upgraded on global tax obligation regulations and compliance demands is crucial for decreasing tax obligation responsibilities. By ensuring strict adherence to tax laws and policies, offshore business can prevent expensive charges and tax obligation conflicts. Looking for expert recommendations from tax obligation professionals or lawful specialists concentrated on global tax obligation issues can likewise supply useful understandings right into reliable tax obligation preparation methods.

Making Certain Compliance and Risk Mitigation

Executing durable compliance actions is vital for overseas companies to alleviate risks and preserve governing adherence. To guarantee conformity and mitigate dangers, overseas firms should carry out extensive due diligence on clients and organization partners to stop involvement in illegal activities.

Moreover, remaining abreast of altering laws and legal requirements is essential for offshore companies to adjust their compliance practices as necessary. Involving lawful specialists or conformity experts can supply beneficial advice on browsing intricate regulatory landscapes and guaranteeing adherence to global requirements. By prioritizing compliance and threat mitigation, overseas firms can improve openness, build depend on with stakeholders, and guard their procedures from potential lawful consequences.

Conclusion

Utilizing tactical tax obligation planning strategies can successfully reduce the economic worry of tax obligations for offshore companies. By distributing revenues to entities in low-tax territories, offshore firms can lawfully decrease their general tax obligations. Additionally, taking advantage of tax incentives and exemptions offered by the jurisdiction where the offshore firm is registered can result in significant cost savings.

By making certain strict adherence to tax obligation laws and regulations, offshore firms can avoid pricey charges and tax disagreements.In verdict, affordable overseas firm formation requires careful consideration of jurisdiction, effective structuring, modern technology use, tax obligation reduction, Continue and compliance.